42 Credit Card Fraud Statistics to Know in 2022

Introduction

Welcome to Life Designers, a trusted consulting and analytical services provider specializing in business and consumer services. In this article, we present you with 42 credit card fraud statistics to help you understand the current landscape and make informed decisions. With our expertise and insights, we aim to empower individuals and businesses in their financial endeavors. Read on to gain valuable knowledge about credit card fraud and protect yourself from potential risks.

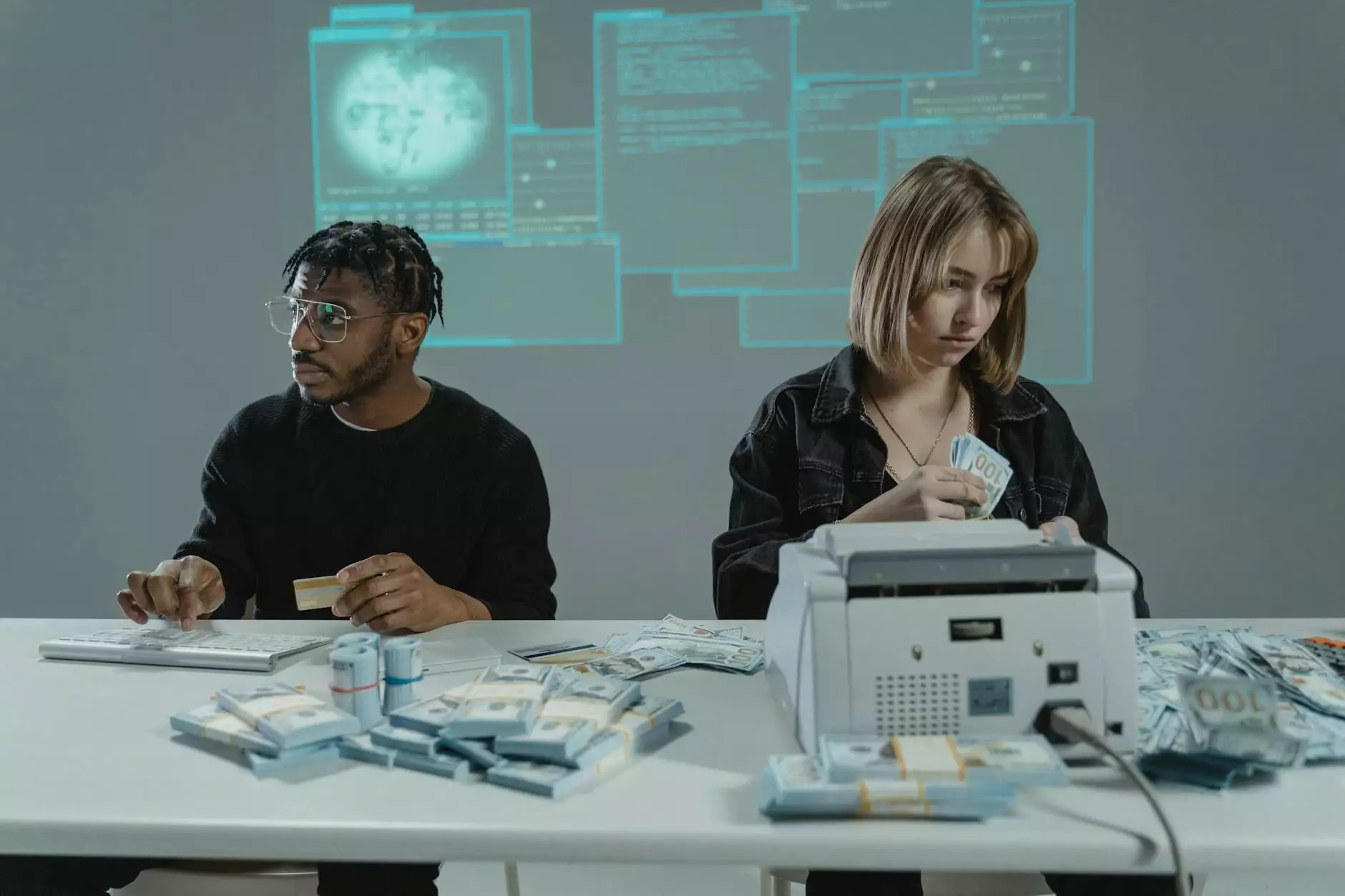

The Scale of Credit Card Fraud

Credit card fraud has become a serious concern in recent years, affecting millions of people worldwide. As more transactions are conducted online and payments become digitized, perpetrators find new ways to exploit vulnerabilities in the system. Let's dive into the statistics:

1. Rising Incidents of Credit Card Fraud

According to recent studies, credit card fraud incidents have been increasing steadily over the past decade. In 2020 alone, over 4.8 million cases were reported globally.

2. Financial Losses

Credit card fraud not only causes inconvenience but also results in significant financial losses for individuals and businesses. In 2020, total losses due to credit card fraud were estimated to be upwards of $27 billion.

...Prevention and Protection

30. Implementing Multi-Factor Authentication

One of the most effective ways to protect yourself from credit card fraud is to enable multi-factor authentication for all your accounts. This adds an extra layer of security by requiring additional verification during logins and transactions.

31. Regularly Monitoring Your Statements

To identify potential fraudulent activity, it is crucial to regularly monitor your credit card statements and bank accounts. Report any suspicious or unauthorized transactions immediately to your financial institution.

...Conclusion

As the world becomes increasingly digitized, credit card fraud poses a significant threat to individuals and businesses alike. By staying informed about the latest statistics and adopting preventive measures, you can minimize the risks associated with credit card fraud. At Life Designers, we strive to provide you with comprehensive insights and solutions to protect your financial interests. Contact us today for expert consulting and analytical services.