Credit Scores Impact on How Much House You Can Buy?

Introduction

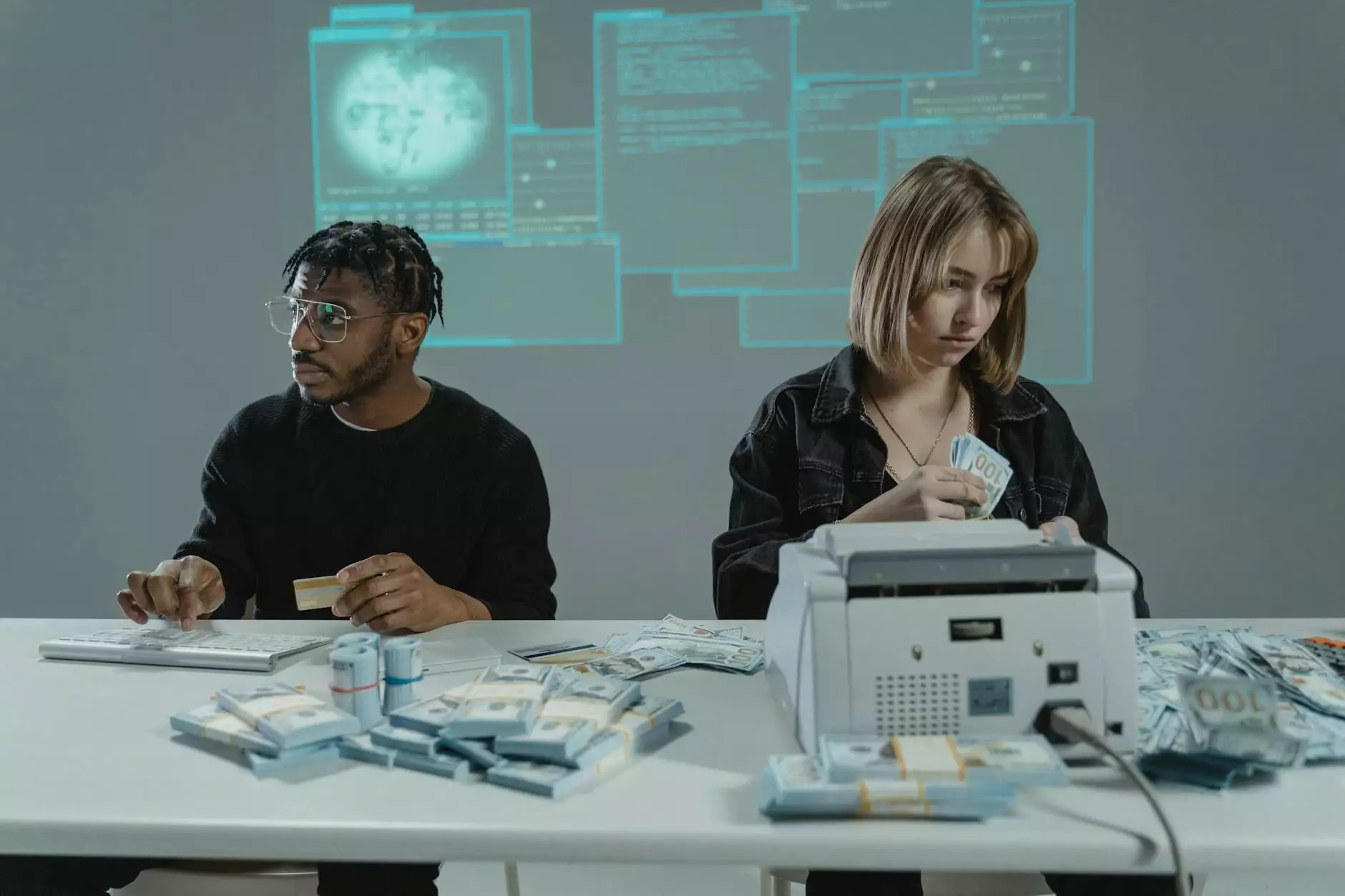

Welcome to Life Designers! We are experts in business and consumer services, specifically in consulting and analytical services. In this article, we will discuss how your credit score plays a crucial role in determining how much house you can buy.

Understanding Credit Scores

Before diving into the specifics, let's understand what a credit score is. Your credit score is a numerical representation of your creditworthiness. It is a measure of how likely you are to repay your debts on time. Lenders use this score to assess the risk associated with lending you money.

Factors Affecting Your Credit Score

Several factors influence your credit score, including:

- Payment history: Timely payments positively impact your credit score.

- Credit utilization: Keeping your credit card balances low shows responsible financial management.

- Credit history length: A longer credit history generally leads to a higher credit score.

- Credit mix: A healthy mix of different types of credit, such as loans and credit cards, can boost your score.

- New credit: Opening multiple new credit accounts in a short period may lower your credit score.

Credit Scores and Home Loans

When you decide to buy a house, lenders evaluate your credit score to determine your eligibility for a home loan. A higher credit score indicates lower risk for lenders, making you more likely to secure a favorable loan with better terms.

Interest Rates and Mortgage Terms

Having a good credit score can greatly benefit you in terms of interest rates and mortgage terms. A higher credit score generally leads to lower interest rates, resulting in significant savings over the life of your mortgage. It also opens up opportunities for better mortgage terms, such as lower down payments or longer repayment periods.

Affordability and Loan Amount

Your credit score also impacts the loan amount you can qualify for. Lenders closely evaluate your credit score to determine your debt-to-income ratio. This ratio is a measure of how much of your monthly income goes towards debt repayment. A higher credit score may increase the maximum loan amount you can afford, allowing you to purchase a more expensive house.

Improving Your Credit Score

If your credit score is not as high as you want it to be, don't worry! There are several steps you can take to improve it:

1. Pay Your Bills on Time

Consistently making on-time payments is one of the most effective ways to boost your credit score. Set up automatic payments or create reminders to avoid missing any payments.

2. Reduce Credit Card Balances

Lowering your credit card balances can positively impact your credit utilization ratio. Aim to keep your balances below 30% of your credit limit.

3. Maintain Credit Accounts

Keep your credit accounts open and active, even if they have a low balance. This helps build a positive credit history over time.

4. Avoid New Credit Applications

While it may be tempting to apply for multiple credit cards or loans, refrain from doing so if you're planning to buy a house in the near future. Opening too many new accounts can temporarily lower your credit score.

5. Regularly Check Your Credit Report

Monitor your credit report for any errors or inaccuracies. If you find any, dispute them and ensure they are corrected promptly.

Conclusion

Your credit score plays a significant role in how much house you can buy. A higher credit score can open doors to better mortgage terms and lower interest rates. By understanding what affects your credit score and taking steps to improve it, you can increase your chances of qualifying for your dream home. At Life Designers, we offer consulting and coaching services to help you navigate the complexities of the credit system. Contact us today to take control of your financial future!