Tax Reform's Impact on 2017 Year End Reporting

Understanding the Changes for a Strong Financial Year-End

Welcome to Life Designers, your trusted partner in business and consumer services. In this comprehensive guide, we will delve into the intricacies of the tax reform and its significant impact on your company's 2017 year-end reporting. Our expert consultants and analytical services will equip you with the necessary knowledge to navigate through these changes and optimize your financial outcomes.

The Importance of 2017 Year-End Reporting

Before we dive into the specifics of the tax reform's impact, let's first understand the importance of year-end reporting. As the fiscal year comes to a close, it is crucial for businesses to assess their financial position and make informed decisions. Accurate and comprehensive year-end reporting enables businesses to evaluate their financial performance, plan for the future, and comply with regulatory requirements.

Overview of the Tax Reform

The Tax Cuts and Jobs Act, passed in December 2017, introduced a multitude of changes that significantly impact businesses. It is essential for companies to familiarize themselves with the new regulations to effectively manage their finances and maximize profitability. At Life Designers, we have carefully analyzed the tax reform and developed expert strategies to help you adapt to these changes seamlessly.

Key Changes Affecting Year-End Reporting

1. Tax Rate Modifications

The tax reform introduced lower corporate tax rates, providing businesses with an opportunity to reduce their tax burdens. While this may seem favorable, it also necessitates recalibrating your financial projections for accurate year-end reporting. Our consulting services will guide you in understanding the implications of these rate modifications on your financial statements.

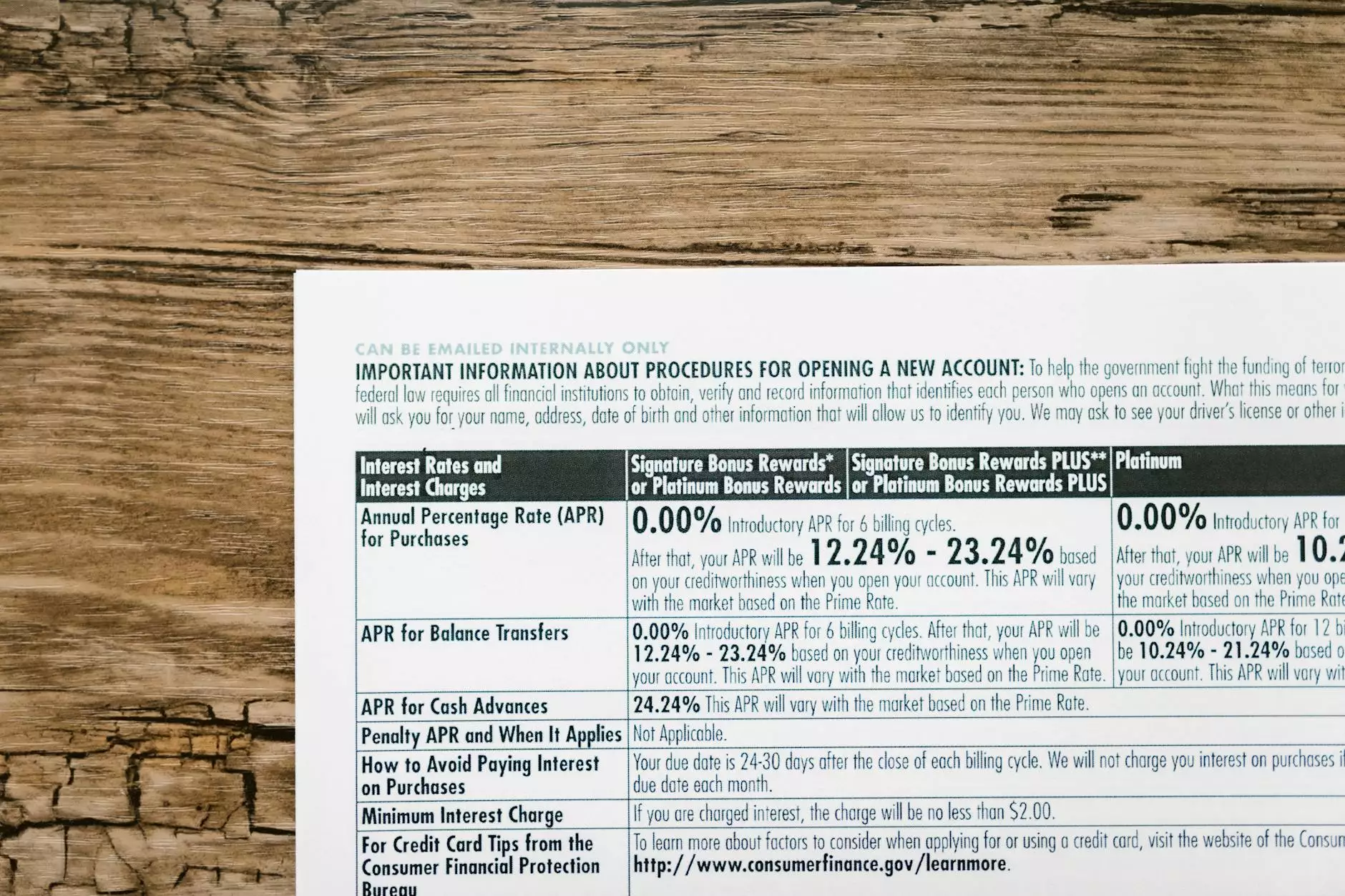

2. Changes in Deductions and Credits

Another crucial aspect of the tax reform is the altering of deductions and credits. Some deductions have been eliminated or limited, while new credits have been introduced. Understanding these changes and properly applying them to your year-end reporting is vital to optimize your tax position. With our analytical services, we will identify the deductions and credits that are most advantageous to your business.

3. International Tax Provisions

The tax reform enacted significant modifications to international tax provisions, including the introduction of a territorial system and the implementation of the Global Intangible Low-Taxed Income (GILTI) rules. These changes affect multinational companies and necessitate a thorough review of foreign operations, income sourcing, and transfer pricing. Our expert consultants will provide invaluable insights tailored to your unique international tax circumstances.

4. Financial Statement Implications

The tax reform's impact goes beyond tax considerations and extends to financial reporting. The adjustments made in tax rates, deductions, and credits may require corresponding changes in financial statements. Accurate and compliant financial reporting is crucial for maintaining transparency and ensuring regulatory compliance. Our consultants will assist you in aligning your financial statements with the tax reform changes to present a comprehensive picture of your company's financial health.

Optimizing Your Year-End Reporting Strategy

With the complexities introduced by the tax reform, it is essential to develop a robust strategy for your year-end reporting. At Life Designers, we offer personalized consulting and analytical services to help you optimize your financial outcomes. Our team of experts will assess your unique business circumstances, understand your goals, and devise a tailored approach that aligns with the tax reform changes.

By leveraging our services, you can:

- Maximize available deductions and credits

- Ensure compliance with tax regulations

- Optimize international tax planning strategies

- Align financial statements with tax reform changes

- Make informed decisions based on accurate data

Conclusion

As you prepare for your company's 2017 year-end reporting, it is vital to understand the tax reform's impact and take proactive measures to adapt to the changes. Life Designers is your trusted partner in navigating these complexities. Our expert consulting and analytical services in business and consumer services provide valuable insights and strategies to help you optimize your financial outcomes. Contact us today to learn more about how we can assist you in ensuring a strong financial year-end.