Does Refinancing Hurt Credit? | CreditRepair.com

Welcome to Life Designers, a trusted consulting and coaching firm specializing in business and consumer services. In this article, we will explore the topic of refinancing and its potential impact on your credit score. If you are considering refinancing your loans or mortgage, it is crucial to understand how it can affect your credit health.

Understanding Refinancing and Credit Scores

Refinancing refers to the process of replacing an existing loan with a new loan, often with more favorable terms. Whether you're looking to lower your interest rates, reduce monthly payments, or adjust the length of your loan, refinancing can offer significant financial benefits. However, it's essential to consider how refinancing may impact your credit score.

How Does Refinancing Affect Credit Scores?

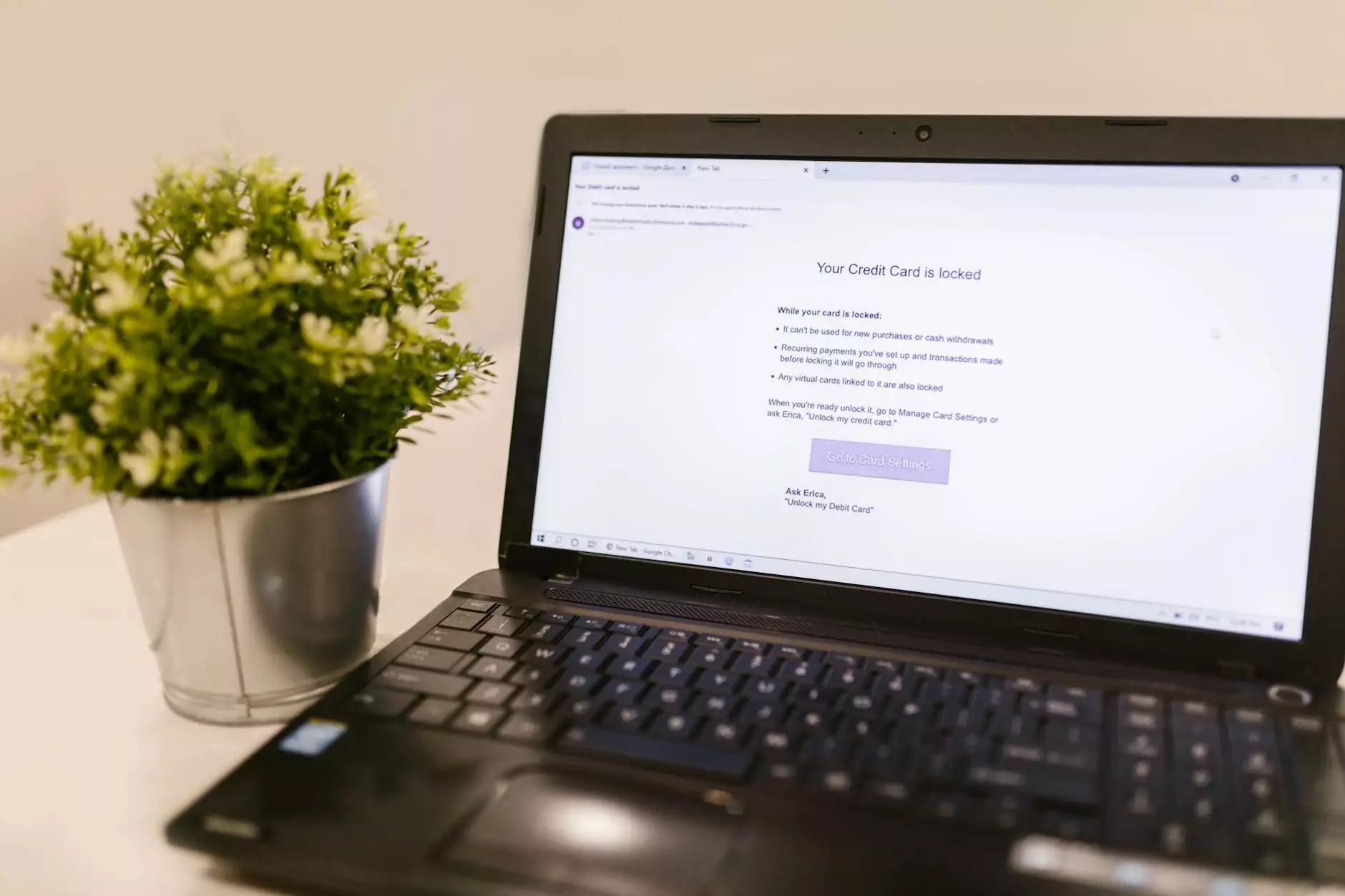

Contrary to popular belief, refinancing itself does not directly hurt your credit score. When you apply for a refinancing option, lenders will perform a hard credit inquiry, which can temporarily lower your credit score by a few points. However, this decrease is typically small and short-lived.

The potential negative impact on your credit score is more likely to occur if you mishandle the refinancing process. Factors that can hurt your credit score during refinancing include:

- Making late payments: Failing to make your loan payments on time can significantly damage your credit score. Ensure you stay on top of your new loan obligations to avoid negative consequences.

- Opening multiple new accounts: While applying for a new loan in the refinancing process might be necessary, opening multiple new accounts simultaneously can raise concerns among lenders and potentially impact your credit score.

- Closing old accounts: Closing old credit accounts can decrease the overall length of your credit history, which may negatively affect your credit score. Evaluate the impact before closing any accounts.

How Life Designers Can Help Protect Your Credit

At Life Designers, we understand the importance of maintaining a healthy credit score while managing your financial goals. Our expert consultants can guide you through the refinancing process and provide you with personalized strategies to protect your credit.

The Life Designers Difference

As a leading consulting and coaching firm, our team at Life Designers brings years of expertise in the field of credit and finance. We offer comprehensive services tailored to your unique needs, ensuring you make informed decisions that positively impact your credit health.

Benefits of Choosing Life Designers

When you partner with Life Designers, you gain access to:

- Personalized credit analysis: Our experts will evaluate your credit profile and provide detailed insights into areas of improvement, helping you make the right refinancing decisions.

- Credit education and coaching: We believe in empowering our clients with knowledge. Through our coaching programs, we equip you with the tools and strategies to maximize your credit scores.

- Strategic refinancing plans: Life Designers will work closely with you to develop a refinancing plan that aligns with your financial goals while minimizing any potential negative impact on your credit score.

- Ongoing support: We are committed to your long-term success. Our team will provide continuous guidance and support, ensuring you maintain a healthy credit profile even after refinancing.

Conclusion

Refinancing can be an effective financial move to improve your loan terms and save money. However, it's crucial to approach the refinancing process with caution, especially regarding your credit score. By partnering with Life Designers, you can navigate the refinancing journey confidently, knowing that our experts are dedicated to your credit health.

Take control of your financial future today and contact Life Designers for a personalized consultation. Let us help you achieve your goals while protecting your credit score.